Sustainable Banking

Bolder And Bigger Goals For People, Planet And Profit.

About the Report

Sustainable Banking in the New Normal is the second Sustainability Report of Metrobank which communicates the manner by which the Bank’s management approach in governing economic, environmental, social and governance issues, as well as the endeavors of the Metrobank Foundation in 2020, have created an impact—leaving an imprint of the Bank’s efforts in environmental and social responsibility concerns.

This report has been prepared in accordance with the GRI Standards: Core Option. The Philippines’ Securities and Exchange Commission’s Sustainability Reporting Guidelines for Publicly listed Companies was also used as reference in making this report, which does not include international operations and those of its subsidiaries, unless otherwise specified.

Journey Towards Sustainability

True to its signature slogan – You’re in Good Hands – Metrobank has become the trusted partner and ally of businesses needing a financial institution that can be relied upon for their corporate and personal banking needs. To continue helping industries grow and assisting individuals in achieving their aspirations, Metrobank has kept pace with the rise of a more socially inclusive and environmentally conscious society.

Metrobank’s material topics describe and communicate the economic, environment and social issues that the Bank and its stakeholders deem most relevant.

The Bank’s material topics are subject to change with the times as to incorporate new guidelines from regulators such as BSP, and to anticipate and address the needs of our stakeholders. Hence, our materiality process is iterative, and our sustainability framework is to be reviewed and revised as the need arises.

Passion For Results

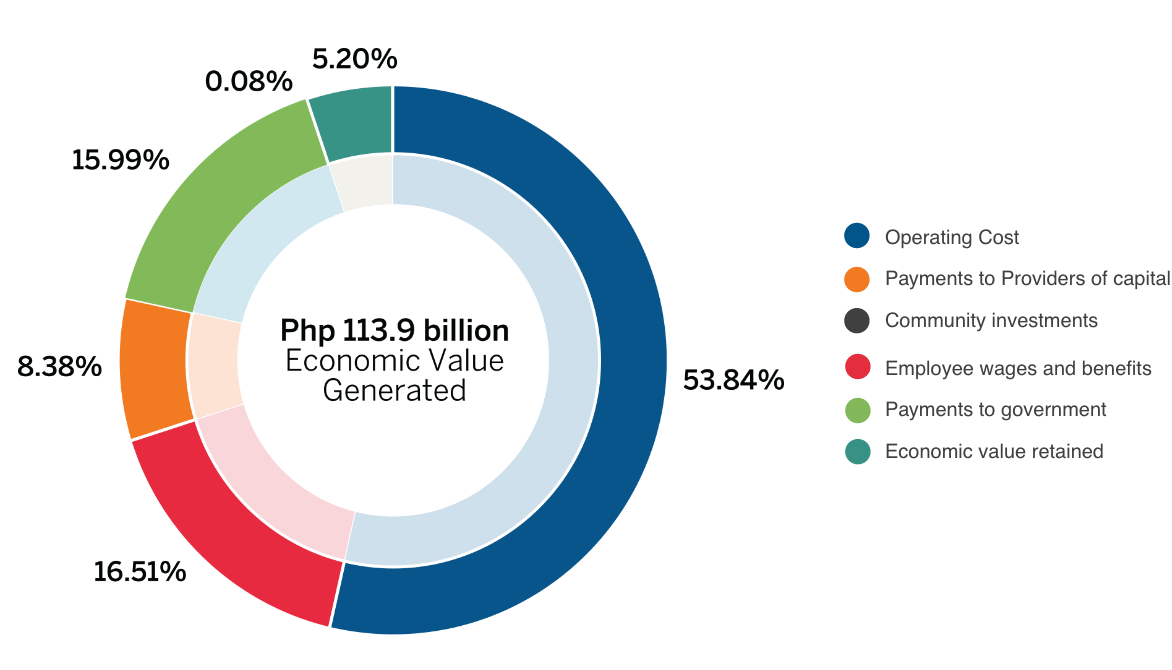

Economic Distribution

Metrobank is relentless in its drive for continued growth and exceptional economic performance. Despite a conservative provisioning strategy in 2020, the Bank registered a strong performance, with an asset base of Php 2.2 trillion and a total equity of Php 325 billion. Meanwhile, the Bank’s direct economic value generated for the year amounted to Php 113.9 billion.

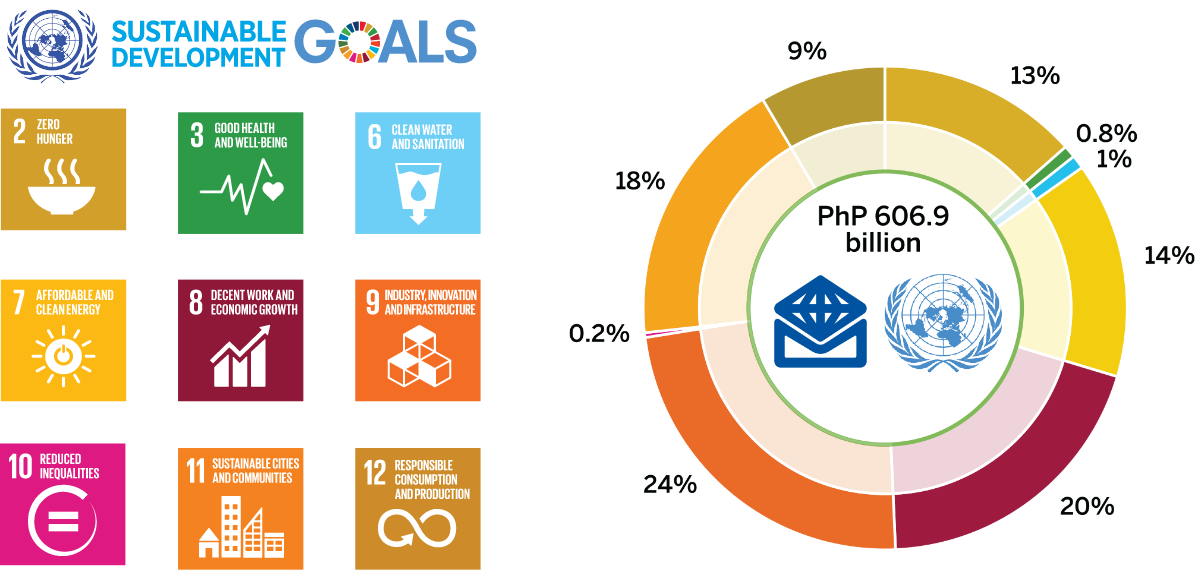

Contribution Of Outstanding Loans To Sustainable Development Goals

Through its Institutional Banking Sector, Metrobank helped contribute to 9 of 17 SDGs in 2020.

Building mechanisms that further develop social capital created more opportunities for economic and environmental conditions to advance in less developed communities. As the Bank continues to refine parameters on determining contribution of outstanding loans to the UN SDGs, the presented numbers in each goal may be amended.

Integrity

Strong Corporate Governance

In all seasons, in all circumstances, Metrobank operates under the philosophy that corporate governance is the cornerstone of its business. This firm adherence to governance is paramount especially at this time when established institutions like Metrobank must assure its customers and clients of innovatively customized products and services for their present needs.

Responsible Business Practices

Aligned with global and national sustainability goals, Metrobank provides reliable products and services that satisfy its customers’ financial needs to unlock wealth, create opportunities, and facilitate trade and commerce. The Bank also sustainably supports its customers through a thorough and effective underwriting that mitigates undue risks. Moreover, the Bank equips customers with the knowledge and skills to effectively manage finances and gain financial freedom through financial education initiatives like MoneyBasics and Earnest.

Teamwork

The Bank considers its employees as partners in building meaningful banking in communities and consistently looks out for their complete well-being. It will always prioritize employee safety, excellent performance, sense of belongingness and provide opportunities for their career development.

As one of Asia’s best employers and companies to work for in 2019, Metrobank fosters a culture of caring, sharing the values of excellence, integrity, and professionalism with its employees who have now taken these to heart. Belonging to the Metrobank family is part of an inclusive work environment where harmony is nurtured in diversity.

Training

Metrobank created an opportunity for growth and put value to its employees’ professional enrichment that will help drive the Bank to achieve its goals. The Metrobank Academy was created for this purpose and offers a slew of courses developed by both in-house and externally-sourced subject matter experts.

Educational Assistance

The value that Metrobank gives to continuous education does not end among its employees but extends to employees’ dependents. The Bank believes that education increases the worth and capacity of its employees, their families and helps form better communities. With this, the Bank has put up two educational assistance programs, namely Metrobank Employees Graduate Assistance Program (MEGA) for qualified employees and Metrobank Educational Assistance for Dependents of Employees Program (MEADE) for qualified employees’ children.

Commitment To Customer Service

Metrobank’s corporate mantra has always been providing its customers with the best customer experience through meaningful banking. The Bank delights in anticipating customer needs and offering solutions for these.

Protecting Customer's Data

Metrobank remains dedicated to nurturing and strengthening its relationship with its retail and corporate clients and constantly prioritizes their best interests. The Bank sets a culture that adheres to the BSP’s customer protection standards and complies with its Consumer Protection Policy Manual.

Consumer Protection Standards

Metrobank’s Customer Protection Standards are inherent to the Bank’s corporate culture and are always observed in its dealings with its customers.

The Bank sees to it that its customers have a reasonable and holistic understanding of all products and services it may choose to avail.

The Bank employs a strong and reliable IT system with well-defined protocols, secure database and periodically revalidated procedures to protect consumer information.

The Bank, through the Fraud Management Division, uses several tools for fraud prevention and mitigation.

The Bank safeguards the best interests of its customers by establishing necessary resources, procedures, internal monitoring, and control mechanisms.

Heart For Community

There is no question that Metrobank has an exemplary business performance to equip its employees with the best skill sets that helps firm up the Bank’s position as a socially responsible industry leader. More than intensifying the business, the Bank and its employees put a premium on the value of community service beyond banking.

Helping Hands During COVID-19

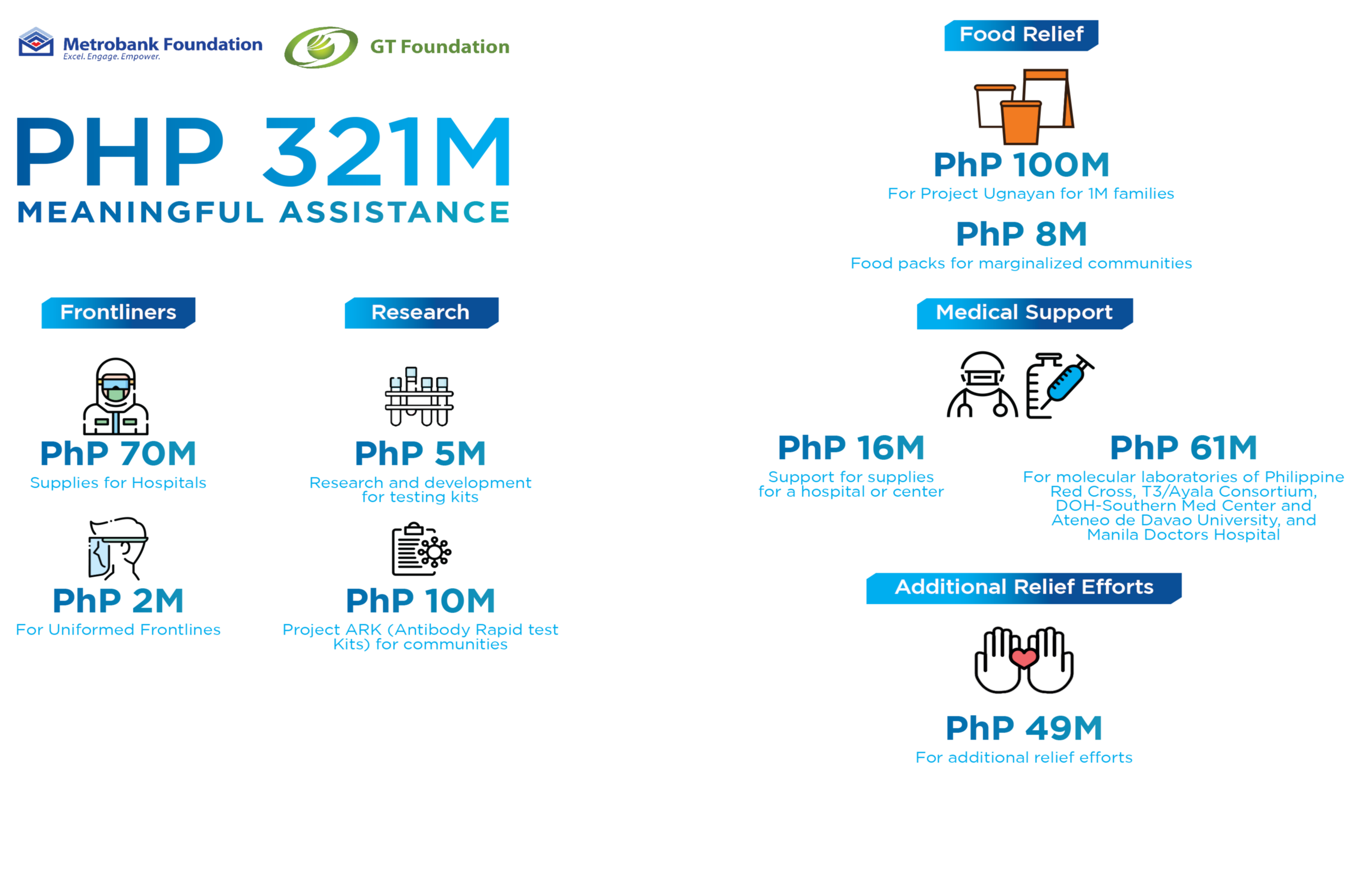

At the height of the health crisis, the two Foundations of the Metrobank Group supported not only the conglomerate’s employees and their families, but also the large communities and front liners affected by the impact of the pandemic.

The massive support that reached Php 321.5 million provided short-term relief and recovery assistance to affected sectors, created a mid-term emergency response plan through strategic partnerships with the government and other stakeholders in communities and directly supported more than 522,000 beneficiaries of CSR initiatives.

Helping Hands During COVID-19

At the height of the health crisis, the two Foundations of the Metrobank Group supported not only the conglomerate’s employees and their families, but also the large communities and front liners affected by the impact of the pandemic.

The massive support that reached Php 321.5 million provided short-term relief and recovery assistance to affected sectors, created a mid-term emergency response plan through strategic partnerships with the government and other stakeholders in communities and directly supported more than 522,000 beneficiaries of CSR initiatives.