Our Approach to Sustainability

5 MIN READ

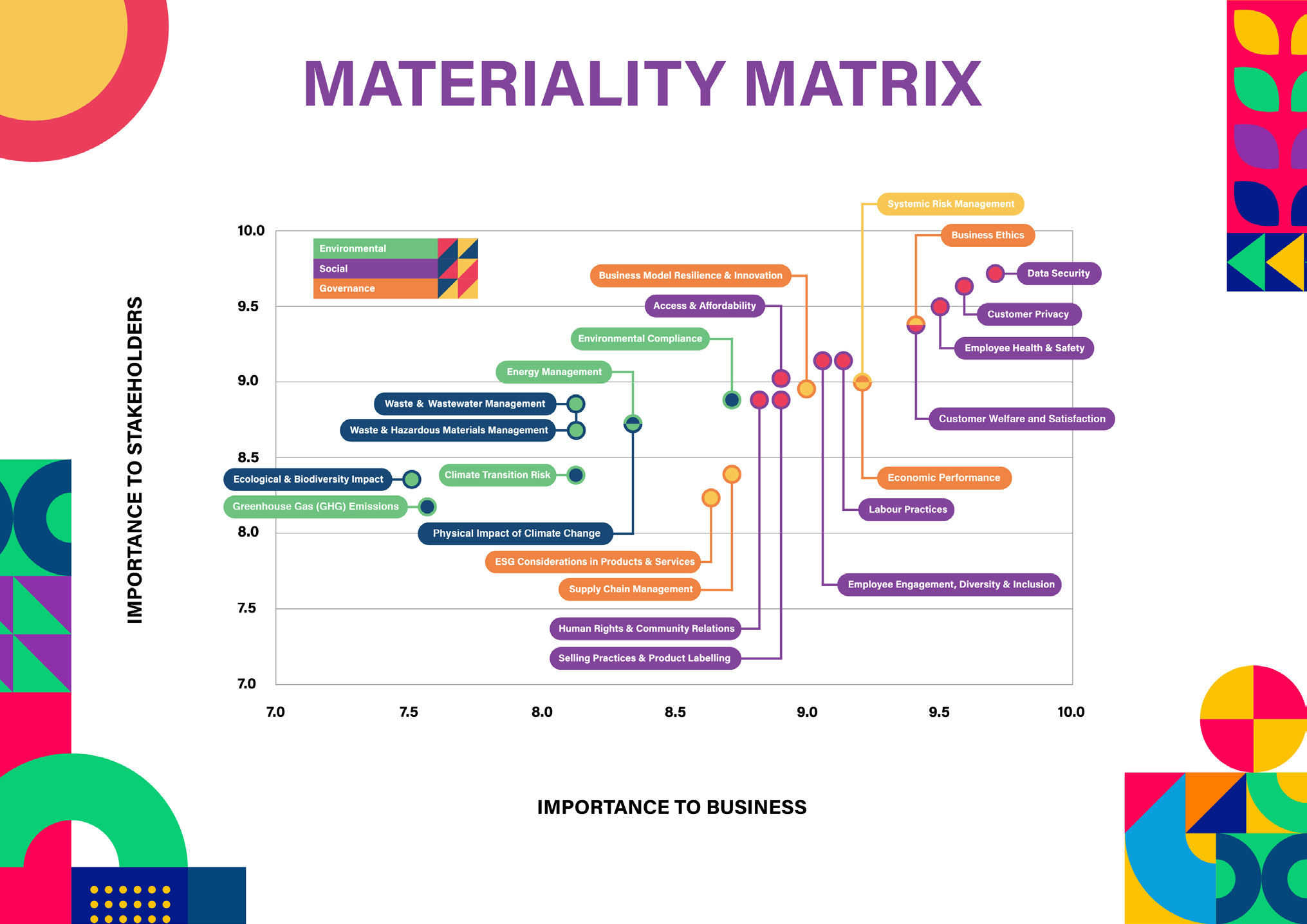

Materiality Assessment

Metrobank evaluates the material social, environmental, and economic topics that the Bank and our stakeholders deem most relevant for our operations. The material assessment exercise was anchored on Sustainability Accounting Standards Boards (SASB), GRI, and SEC Philippines’ guidelines, and a review of practices reported by our peers.

Metrobank has identified key issues that are material for the organization, including data security and customer privacy, customer welfare and satisfaction, and employee health and safety. Moreover, the Bank sees good governance as imperative in topics such as business ethics, systematic risk management, and good economic performance.

| Theme | Relevance | Aligned Material Topics[1] | Topic Boundary[2] | Relevant SDGs |

|---|---|---|---|---|

| Approach to Sustainability | As a publicly listed company, we embed sustainability principles into our governance framework and risk management process. | •Integrating Sustainability Principles* •Materiality Assessment* •Stakeholder Engagement |

Internal and External (customers, suppliers, regulators, and community beneficiaries) | |

| Economic | As a financial institution, we strive to provide for our customers’ financial needs. We also continue tracking our direct economic contributions by meeting our financial obligations to key stakeholders. | •Sustainable Finance •Economic Performance •Procurement Practices* •Tax Strategy* |

Internal and External (customers and suppliers) | |

| Environmental Sustainability | We manage our environmental impact through prudent use of natural resources and compliance with environmental laws and regulations. | •Operational Eco-Efficiency •Environmental Compliance* · -- Waste & hazardous materials management · -- Greenhouse gas (GHG) emissions |

Internal |

|

| Social Sustainability | As an employer, we strive to provide an exceptional workplace environment so our employees find meaning in their work. We continually invest in their health, professional growth, and personal development. As a financial services provider, we address our customers’ various needs through our diverse products and services, which are accessible and reliable via numerous platforms. As a partner and corporate citizens, we listen and engage with our stakeholders to foster long-term relationships, protect their interests, and optimize our social impact. |

•Workforce Diversity* •Talent Attraction and Retention •Human Capital Development •Occupational Health and Safety •Responsible Labor Practices •Financial Inclusion •Consumer Financial Protection •Information Security and System Availability •Privacy Protection •Transparency in products and services •Corporate Citizenship and Philanthropy |

Internal and External (customers, suppliers, and community beneficiaries) | |

| Governance | As a member of a highly regulated industry, we have built a stable and responsible brand with a credible and trustworthy reputation. Our track record in transparency, dependability, and accountability allows us to build lasting relationships with our stakeholders, and entice new partners and customers. | •Governance Structure •Good governance and integrity •Corporate Policies and Practices •Management of Environmental and Social Risks |

Internal and external (customers and suppliers) |

[1] Topics highlighted in asterisk (*) refer to existing corporate policies and disclosures covering our list of material topics. [2] Internal refers to the Bank, its operations, and its people. External involves our relationships with other stakeholders.